A Look Back at 2022: A Crazy Year in Venture Capital

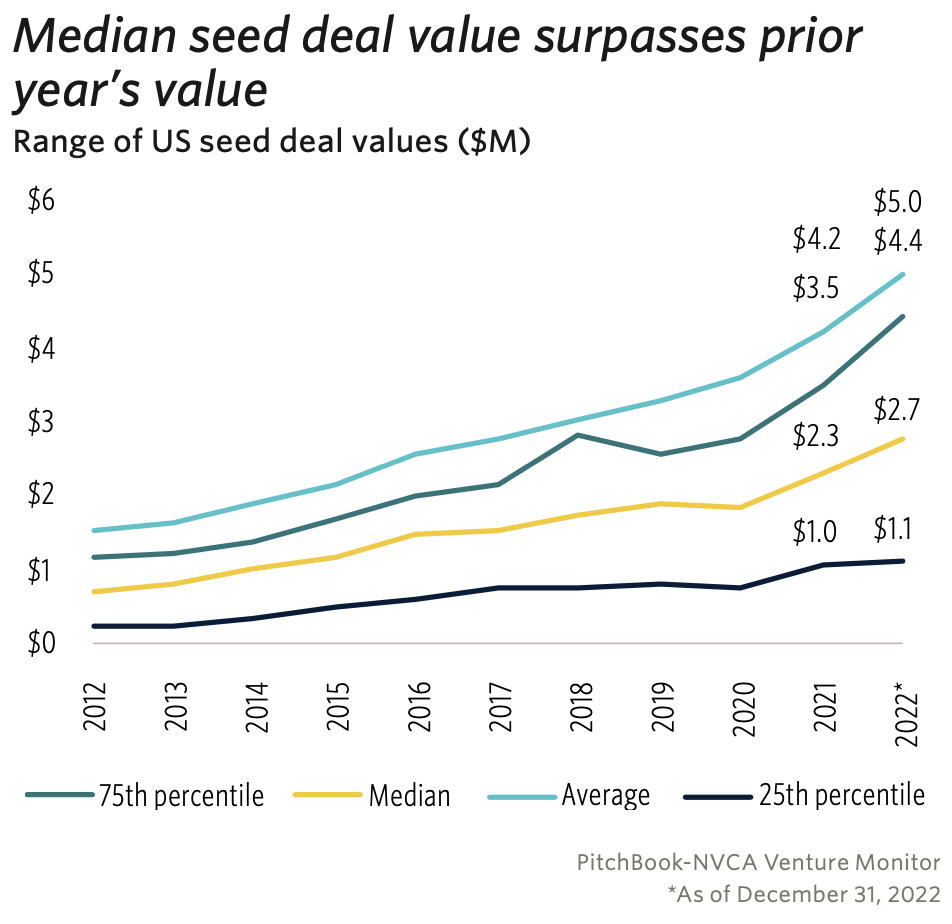

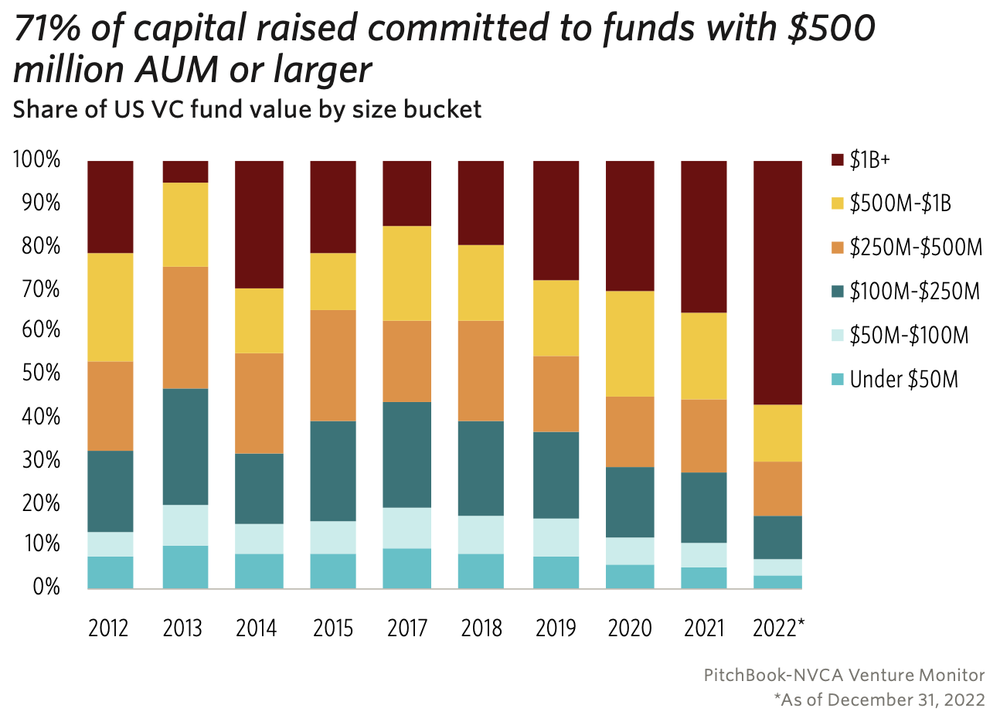

2022 proved to be a year in the world of venture capital that people will talk about for decades to come. After the record-breaking year of 2021, the challenges of 2022 in the VC world were dramatic, obscuring the fact that the metrics of industry activity overall were strong. Given growing economic uncertainty and threats of a recession, the venture world faced a year of declining deal counts, halted exit and acquisition activity, and shifting of investment to early-stage and seed-stage rounds from early and late stages. In this blogpost, I’ll share a few of the highlights from 2022 and what it could mean for 2023. 1. Economic uncertainty leading to a decline in overall annual deal countRelative to 2021, the overall annual deal count was down in 2022, falling from 18,521 to 15,852. This decline had a variety of causes, but most specifically stemmed from the general economic downturn. Nontraditional investors (such as corporations, foundations, private equity, and hedge funds) turned away from VC in search of more attractive risk/return profiles, leading to the first decline in nontraditional investor deal counts since 2016. 2. Growth in seed-stage deal sizes and pre-money valuationsAngel and seed-stage deal value grew while deal count dipped slightly, meaning that deal sizes grew. The resilience of this market is due to a variety of trends, including wider participation of seed-stage investors, longer time between startups’ foundings and seed-stage fundraising rounds to gain maturity, and a stronger pre-seed market more generally. The median seed deal size grew by 19.4%, which can be attributed to startups raising more capital earlier in their lifecycles to retain talent and avoid fundraising in harsher economic environments. Valuations grew in line with deal size, as seed stage valuations are usually tied to startups’ capital needs. 3. Negative trend in early-stage investmentsEarly-stage investments (generally Series A and B) showed promise in the first half of 2022, but slowed in the second, with 63% of the year’s deal value coming from the first two quarters of the year. 73% of the capital invested in the early-stage were consolidated in deal sizes greater than $25 million, further illuminating the trend of larger, more compressed rounds. Overall, startups had lower early-stage valuations, as investors were more cautious about outsized valuations. 4. Descending late-stage investments, with exits and acquisitions haltedLess insulated from difficult economic conditions, late-stage startups (Series C and D) felt the heat of the downturn, with Q4 2022 showing the lowest quarterly deal value since 2018. The median late-stage pre-money valuation also decreased by 10% YoY, due in large part to the public market downturn. Klarna, a Stockholm-based provider of buy now, pay later technology, suffered one of the steepest drops in value among big-name startups: the company raised financing at a $6.7 billion valuation in 2022, an 85% discount to its prior valuation of $46 billion. Exits, both public and private, came to a screeching halt in 2022. Public listings dwindled to just 14, with IPO deal proceeds plummeting 94% in 2022. Publicly listed VC-backed company post-money valuation median fell by $550M, demonstrating the difficulty of the public stock market. Acquisitions also fell due to the increasing cost of capital, with the number of buyouts and the post-money valuation of buyouts declining. Even still, acquisitions made up the majority of exit value in 2022, shifting the trend away from public listings.5. Record venture fundraising, but consolidated to larger fundsIn more positive news, venture fundraising set an annual record in amount raised, growing by 6% YoY. Much of this was concentrated in the larger-sized funds, as 71% of the capital raised was committed to $500 million+ funds. Given the difficult economic environment, investors are more likely to stick to what’s tried and true rather than taking risks on new, emerging managers - despite the fact that emerging managers outperform.So, what does this mean for 2023 and the future of VC writ large? The expectation is that the macro environment will remain challenged for much of 2023. The companies that raised in the hey-day of 2021 will likely need to tap the capital markets again in the coming quarters - and VCs will need to balance financially supporting existing portfolio companies vs. new investments. Valuations are likely to be down across all stages, and for VCs that have sufficient dry powder to invest, 2023 could be a year of opportunity. At Rise Together Ventures, we’re more inspired than ever in the value of our investment model, empowering companies to invest in both performance and purpose. Georgia Hoagland