What does Silicon Valley Bank have to do with The Notorious B.I.G.?

Answer: Mo Money Mo Problems.

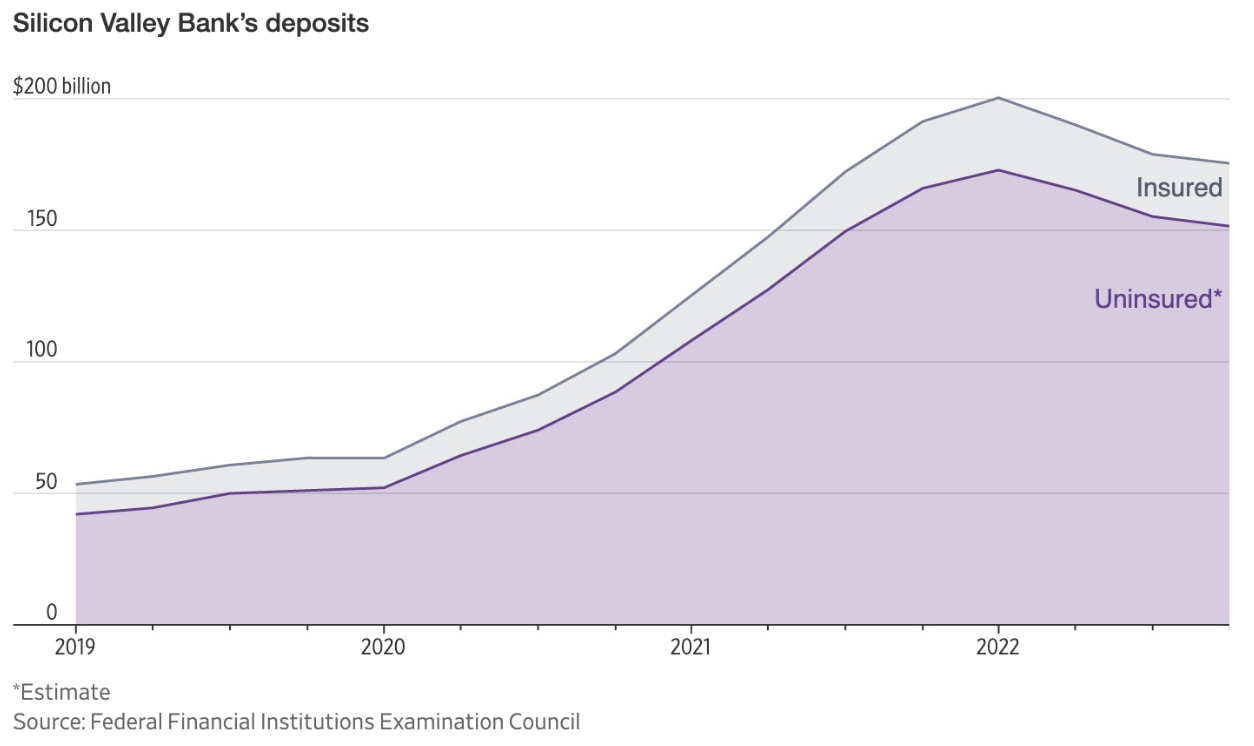

It has undoubtedly been quite a volatile couple of weeks for the tech + banking sectors. Beginning with the Silicon Valley Bank and Signature Bank fallouts, and resulting worry spreading to First Republic and now the Credit Suisse situation, it is a fragile time for banks, startups and investors alike. For those of you who haven’t read enough on this banking crisis yet, I’m recapping in simple words and charts how Silicon Valley Bank - the US’s 16th largest bank - failed in 48 hours (making it the second largest bank failure behind Washington Mutual in 2008); and ultimately how bank failures, and this one in particular, can affect the role impact plays at tech companies.A Brief Recap using charts (and why Mo Money → Mo Problems):The years 2019-2021 were a couple of golden years for the tech world and as a result, Silicon Valley Bank (SVB) experienced a boom during these pandemic years (SVB caters to the startup/tech world). As tech companies raised huge financing rounds and saw tremendous growth, SVB’s $60 billion in total deposits at the end of the first quarter 2020 quickly rose to nearly $200 billion two years later. (This is the “Mo Money” part.) As all banks do, SVB invested their deposits - and in their case, they invested billions in long-dated U.S. government bonds.As the macro environment dramatically shifted in 2022, the Fed imposed rate hikes to curb inflation. If you didn’t take finance 101 in college, a quick lesson: interest rates and the price of bonds have an inverse relationship - meaning the bank's bond portfolio lost significant value.At the same time, as depositors (i.e. tech companies) began burning more cash vs. depositing it, SVB had to sell bonds to shore up liquidity - and unfortunately had to sell them at a loss (long dated bonds). SVB was forced to recognize a $1.75 billion loss after the sale, and on March 8 it announced to investors that it needed to fill this gap by raising capital. Enter, panic. Have you ever seen the movie “It’s a Wonderful Life”? Classic old black and white movie - a must-see if you haven’t, btw. A Christmas favorite - and a 95% on Rotten Tomatoes! Anywho, the opening scene is a run on the bank, and that is basically what happened as a result of SVB’s announcement. A total loss of trust and resulting panic and chaos. Ultimately there were $42 billion of deposit withdrawal requests the week the bank was shut down. (Yes, this is the Mo Problems part.)SVB was not in a strong enough financial position to sustain this run on the bank - I particularly appreciated the below graph from JPM that shows how SVB was an outlier in their deposit base risk:Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

The bank was shut down on Friday, March 10. The government has since stepped in to ensure all depositors are made whole; however, this type of collapse has systemic effects throughout the banking system. Most recently First Republic Bank is feeling the pain. What does this have to do with impact? The tech world has experienced mass layoffs in the past year; and we may see more now as trust in the banking system, especially one that focuses on tech startups, breaks down. Unfortunately, typically the first teams to experience headcount or budget cuts during times like these are the impact/CSR teams; they are often viewed as excessive and not core to the business - and many CSR programs are, if not built correctly. In times of uncertainty, it is of utmost importance for companies to focus on lean operations and getting to profitability (well, generally companies should always focus on this). When impact is built into the core of a company - and provides a measurable, positive ROI benefit to a business (increased employee engagement, customer stickiness/price insensitivity, etc.) - then there should be a strong case to keep the impact program in place and growing, even during downturns.Kasey Reiter